With technology advancements and the surge of online transactions arises the risk of cyberattacks such as phishing and unauthorized access to sensitive information. Did you know that weak passwords cause 81% of all data breaches? Given the growing need for enhancing online security measures, One Time Password (OTP) has emerged as a simple and smart choice for individuals and organizations looking to beef up their online security.

What is OTP Verification?

A one time Password is a password or code that is automatically generated and sent to a digital device to allow a single login session or transaction. Also known as a One-time PIN, one-time authorization code (OTAC), One-Time-Pass Code, or dynamic password, OTP mitigates several risks of traditional static password-based authentication.

OTPs are randomly generated numeric codes to authenticate login attempts and transactions. The unique codes are difficult to guess, adding a strong layer of security for each authentication event.

OTP verification plays a critical role in 2-Factor Authentication (2FA) solutions implemented by leading financial service providers and government institutions to ensure the highest level of security for customer transactions.

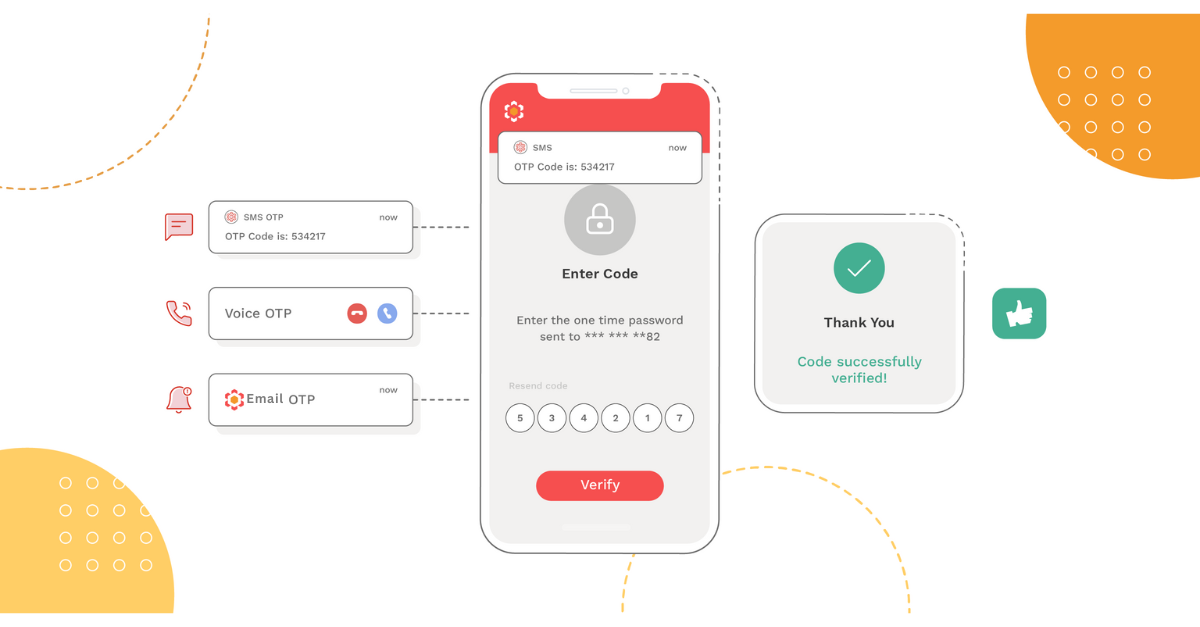

OTP security codes have become a popular method of enabling a single login to validate a new account or confirm a legitimate transaction. OTPs consist of numbers or a string of characters automatically generated and delivered to the user’s devices by SMS, Voice, Email, or Push messages.

How are OTPs Better than Traditional Passwords?

Enterprise systems need more than static passwords to protect sensitive data. Standalone passwords can result in exposed data since they cannot effectively verify if the user trying to access data is authentic or a cyber threat actor. According to Forrester, about 80 percent of security breaches are due to compromised privileged credentials. Unfortunately, traditional passwords are not enough to account for the human element that causes most breaches globally due to weak or stolen passwords.

OTPs are far more secure than static passwords because they typically expire after a short period. Unlike traditional passwords that one can use for months without changing, you can use OTP codes only once. OTP verification involves secure technology that ensures that only the authorized person can access data or an account.

You can ensure login verification by sending One-Time Passcodes (OTPs) to a user’s phone number. By confirming deliverability to the right user, you can prevent malicious attacks by bots and hackers. In addition, businesses that require highly secure solutions use a combination of OTPs and passwords to minimize the risk of fraudulent activities.

How is an OTP Code Generated?

A One Time Password is usually a six-digit number sent to a user’s device via SMS message, email, or voice message. An OTP platform involves an authentication server, which verifies the information a user enters and prompts for a code. The authentication server generates and sends the OTP message to the user. Then, the authentication server verifies the OTP entered by the user and authenticates the transaction or account login.

OTP values are generated using the Hashed Message Authentication Code (HMAC) algorithm and a moving factor. The two common types of OTPs are Hash-based OTPs (HOTP) and Time-based OTPs (TOTP).

HOTP vs TOTP

HOTP:

Uses the counter as a moving factor

The counter is incremented after code generation

Codes expire after use or a new OTP request

Codes cannot be used more than once

Also called event-based OTPs

TOTP:

Uses time as a moving factor

OTP values have timestamps such as exact minute and second

Valid only for a certain period

Codes expire after use or after a set amount of time (typically within minutes)

Also called Time Synchronized OTP

How is an OTP Sent?

SMS is the most common way of delivering OTP messages due to the easy accessibility on mobile phones. However, there are other ways to send OTPs, such as voicemails, push messages, and emails.

SMS OTP Verification

When a user attempts a transaction or login, an OTP is sent as an SMS message to the mobile phone on the number linked to their account. Once the user then keys in the code, the authentication server verifies the user. Since SMS OTP services does not require an internet connection and can be sent to all mobile phones, it is a popular OTP delivery method. Moreover, since mobile phones generally need an unlock code, text OTPs add an additional layer of security.

Although SMS is not intended to be an instant messaging platform, mobile networks worldwide can deliver a text message to recipients in just a few seconds. SMS messages are hence a widely used method to send one time passwords.

Voice OTP

Voice OTP involves pre-recorded messages with unique codes played over a phone call. Once the user enters the code in the voicemail, the server verifies the user, completing the authentication process. Voice OTPs are especially helpful for users with sight issues. Moreover, since the password is not stored on the user’s mobile phone, it can be highly secure. Voice OTP is an excellent alternative to SMS codes and can be a fallback for SMS OTP verification.

Push OTP

Push OTP delivery involves sending a unique code as a push message to the user’s app. Push notification does not require a mobile signal and can be sent to phones with an internet/data connection. Furthermore, since push messages can only be received by the user already logged into the app, it is a secure way to deliver OTPs.

What are the Benefits of One-Time Passwords?

More Secure

OTP PINs are simple yet complex, making them practically impossible to hack. Moreover, they are highly secure since they are unpredictable and not stored on a computer.

The primary benefit of OTP authentication compared to standalone passwords is that they are safe from replay attacks. For example, if a cyber threat actor gets hold of your OTP, they cannot use it again because it is valid only for a single session. For the next login attempt or transaction, a new, random OTP is generated.

Easy to Use

One-time codes are standard practice for everything from activating a bank card to resetting a password. Most people own a mobile phone, and SMS is available on all devices. Because SMS is so common, one-time passwords are convenient to use.

Highly Reliable

OTPs sent through reliable channels such as SMS and voice are typically delivered in minutes or less. If a user does not receive OTP on time, they can request another OTP, and the authentication server attempts to resend the OTP for verification.

Multiple Verification Tasks

OTP (One-Time Passwords) are pretty common in the financial industry, but they are increasingly becoming more prevalent on several websites and applications to authenticate legitimate access to data.

OTPs can be used to reset forgotten passwords, complete a transaction, sign up or log into accounts, and verify online purchases. OTP also helps reduce friction in the customer journey. For example, lost/forgotten passwords can lead to dropoffs, and OTPs can help users quickly regain access to their accounts. Moreover, SMS and Voice OTP can help users complete authentication on their mobile devices, avoiding the risks of using public computers with unsecured Wi-Fi connections.

Level Up Your Security with Kaleyra’s Verification Tool

With Kaleyra’ s robust verification tool, you can ensure the highest level of security for your customers. Safeguard your business against fraud and earn customer trust by securing access to your platform. Gain strategic insights on our user-friendly dashboard by viewing the OTPs (One Time Password) generated and their usage status. Enable instant OTP verification with Kaleyra’s Verify API and enhance your security across processes with our scalable integration.

Kalaivani Narayanan

Content Specialist

Supercharge Your Communication!

Get in touch with our experts who strive hard to bring the very best in cloud communications technology to you.