The trusted communication platform as a service

Omnichannel business communications

Kaleyra is the API-based platform to engage your clients with personalized messages, chatbots, programmable voice services, and more.

Trusted by

Amazing cross-channel customer experiences

SMS

Transactional messages, OTPs, promotions: all delivered timely and safely to your customers’ mobile phones.

Voice

IVR, Click-to-Call, call forwarding, call recording, and call masking features for any app, platform, or website.

Conversate with your customers on the most widely-used instant messaging app, and send media attachments.

Chatbots

Automate your customer engagement flows with AI-based chatbots for scalable customer interactions.

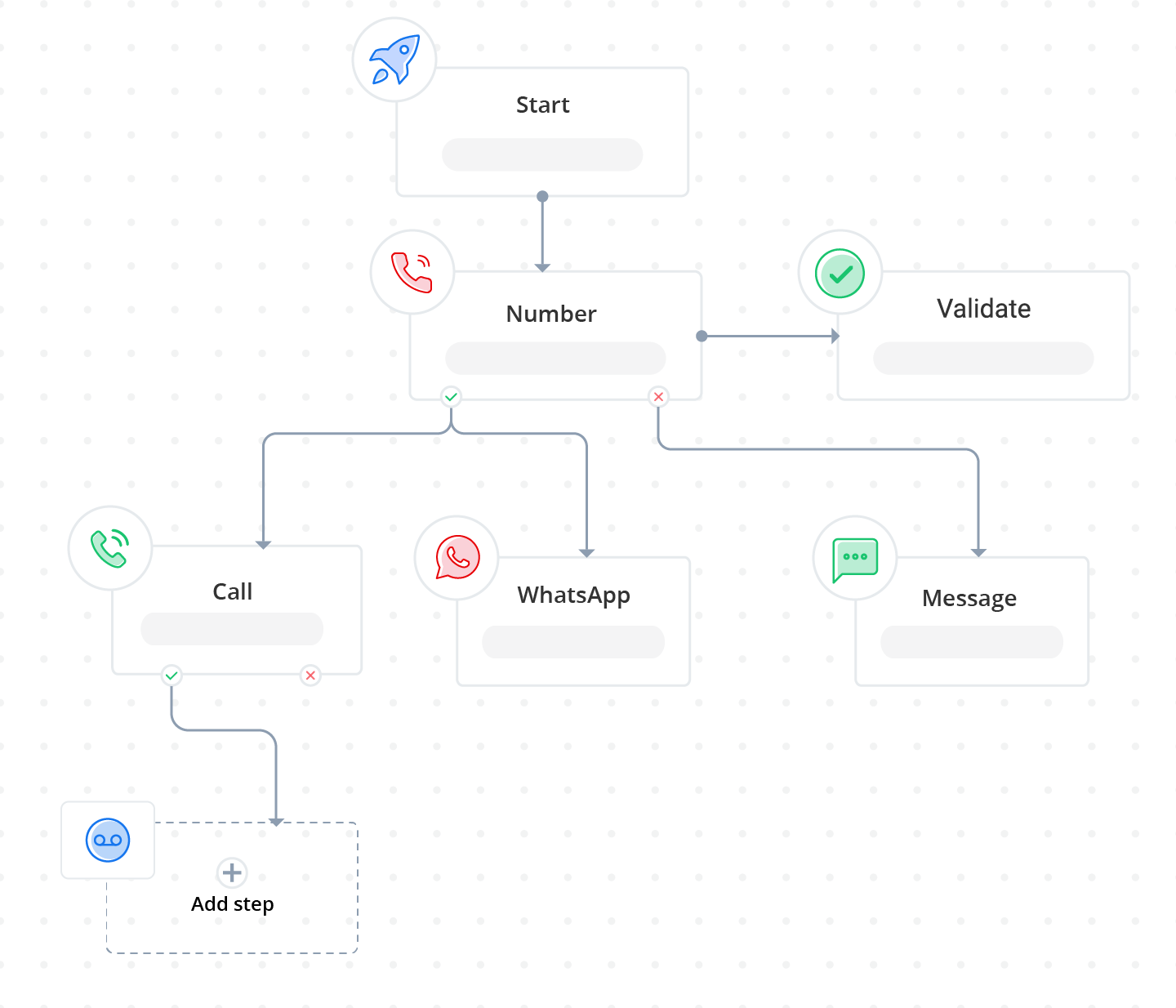

Flowbuilder

Bring cross-channel automation flows to life, in minutes

Design multi-channel communication flows with our easy drag-and-drop visual editor. Or use our pre-defined templates.

Integrations

Do more within the platforms you already use

Kaleyra’s programmable communication API integrates with the leading helpdesk software, e-commerce platforms, CRMs, and marketing tools. We took care of the coding, so you don’t need to.

Why Kaleyra?

Why Kaleyra?

Proven Communications Technology

51.5 Billion

Messages, 2022

8.1 Billion

Voice Calls, 2022